Current Scam Alerts

Visit here for the latest Scam Alerts from the Federal Trade Commission.

Information on Cryptocurrency ATMs and QR Code scams.

{beginAccordion h2}

Types of Fraud & Scams

Identity Theft

Identity Theft is when someone obtains your personal information and uses it for their benefit. They may use the information to secure loans, run up bills, access your personal accounts and impersonate you for financial gain. See below for tips to avoid identity theft.

Phishing / Smishing / Vishing

Phishing / Smishing / Vishing

Phishing is when you get emails, texts or calls that seemed to be from legitimate companies or people you know but they’re actually from scammers. These scammers try to get you to click on a link to give away personal information or ask you for your information so they can gain access to your accounts or steal your money or identity.

Smishing is similar to phishing, but instead of email the scammer uses text messaging.

Vishing is similar to phishing and smishing, but the scammer uses phone services such as a live phone call, a "robocall" or a voicemail to try to trick you.

Money Mule

“Money mules” are people who are used to transport and launder stolen money or merchandise. Criminals may even recruit money mules to use stolen credit card information.

Some money mules may be willing participants, but many of these money mules are not aware that they are being used to commit fraud. The most common money mule schemes are disguised as “work from home” opportunities. These advertisements often target unsuspecting people who are interested in the convenience and flexibility of these types of jobs and since there are companies that legitimately offer opportunities to work from home, people may not recognize malicious offers. Learn more about money mules here.

Online Auctions, Classified Listings and Overpayment Scams

These scams involve a scammer offering to by an item or pay for a service in advance. They then send you a cashier's check for an amount higher than what was agreed upon; they apologize for mistake and ask you to refund the overpayment. The scammer's goal is to get you to cash or deposit the check before you or the bank realize it's fake.

Grandparent Scams

These happen when a scammer hacks into someone's email and sends out fake emails to friends and relatives claiming that the account owner is stranded abroad and might need you to wire money or share our credit card information so they can get home. If you receive an email like these, make sure you contact the sender through another means before sending any money or information. Learn more about grandparent scams.

Imposter Scams

There are many types of Imposter scams, but they all work the same way: a scammer pretends to be someone you trust to convince you to send them money. Learn how to spot an imposter scam.

Health Insurance and Healthcare Schemes

This type of fraud is related to health care benefit programs, health insurance, and COVID-19 health care relief funds. Criminals are adapting known health insurance and health care fraud to take advantage of the pandemic. Types of scams include:

- Unnecessary services: Fraudsters may order or submit claims for expensive tests or services that may not be necessary or related to the health concern.

- Billing schemes: Scammers may bill for services not actually provided or overbill for the services rendered.

- Telefraud and telehealth schemes: Fraudsters will often link their requests for information to COVID-19 treatment and prevention, such as testing or protective equipment. They try to collect your personally identifiable information (PII), including Medicare information.

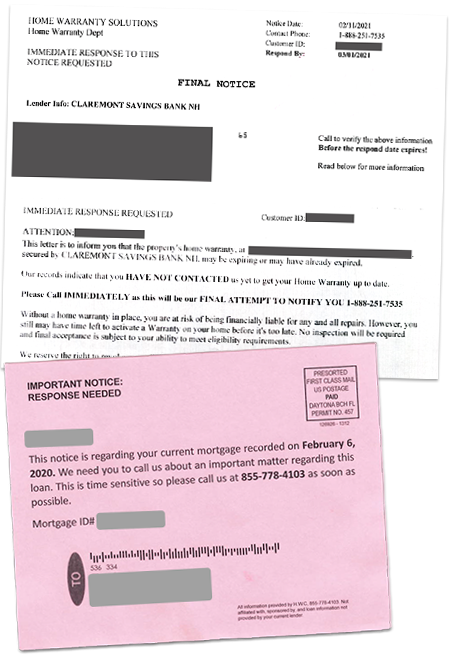

Home Warranty & Mortgage Scams

There are many companies that will use information in public records to contact you regarding your mortgage or mortgage insurance. It's important to be aware and cautious when receiving unexpected solicitations.

There are reputable home warranty companies with satisfied customers, but there are also many companies that take advantage of people or misrepresent themselves. Before purchasing a home warranty, it’s important to look for red flags and do your research.

Tips to Help Avoid a Home Warranty Scam:

- Research the company online and look for user reviews and ratings.

- Be skeptical if the company is presenting itself in a way that looks like it’s partnering with your mortgage company or financial institution – always contact the other business directly to question this.

- Check with your state’s Attorney General’s office or Better Business Bureau to find out if complaints about this company have been filed.

- Be cautious of companies using scare tactics to pressure you to sign up quickly.

- Watch for spelling and grammar mistakes on the website or in emails or letters.

- Review the terms and conditions of the home warranty contract before signing.

Mortgage Scam Red Flags:

- The letter or postcard doesn't have your mortgage company's or bank's logo.

- It's very generic.

- There's a sense of urgency or it's labeled as "time-sensitive".

Fraud Prevention

How to Recognize Fraud

It’s not always easy to recognize fraud because fraudsters have worked really hard to make their scams seem legitimate. It’s important to always consider the following things:

- Ask yourself if the offer seem too good to be true?

- Do an online search for the name of the company or product with the word “scam” and search for online reviews.

- Websites, emails and letters with poor spelling and grammar are often scams.

- Beware of requests for unusual payment methods like cryptocurrency, prepaid debit cards, gift cards or wire transfers.

- Is there a sense of urgency or are they using scare tactics to get you to act quickly? This is a common technique used by fraudsters to scare people into taking action without properly researching or considering the legitimacy of the offer.

Tips to Avoid Identity Theft

- Never share your personal information with a stranger.

- If you’re using a Wi-Fi connection, ensure the connection is secure before logging into sites to access personalinformation.

- Use strong passwords with 8 or more characters that includes a mix of numbers, symbols and uppercase and lowercase letters.

- Review your financial transactions regularly for any signs of unusual activity.

- Request your credit report at least once a year at annualcreditreport.com

Tips for Online Shopping

- Do not click on links in unsolicited emails or texts.

- Check the security of websites before entering your personal information or ordering by looking for the website’s trust seal and http s :// at the beginning of a web address.

- Beware of websites or individuals selling products claiming to prevent, treat, diagnose or cure COVID-19.

Resources

Better Business Bureau Find and Report a Scam

https://www.bbb.org/scamtracker

Federal Trade Commission Consumer Information Scam Alerts

https://www.consumer.ftc.gov/features/scam-alerts

Federal Trade Commission Consumer Alerts

https://consumer.ftc.gov/consumer-alerts

Consumer Financial Protection Bureau

https://www.consumerfinance.gov/consumer-tools/fraud/

FDIC Consumer Assistance Information

https://www.fdic.gov/resources/consumers/consumer-assistance-topics/cybersecurity.html

National Cybersecurity Alliance - COVID19

https://staysafeonline.org/covid-19-security-resource-library/

NH Bankers Association Fraud Protection

Report suspected scams to the FTC at 877-FTC-HELP (877-382-4357) or at ftc.gov/complaint

Report suspected COVID-19 fraud to [email protected]

{endAccordion}